Investment Management - Fourth Quarter 2021

We provide a copy of our investment management letter, without enclosures, to keep you up-to-date on the investment markets and West Financial Services.

We Have Lift Off!

Looking back over last year, individuals yearned for the post-pandemic environment. The vaccine roll-out had everyone hoping for a return to their old routines. During that time, governments and central banks continued to provide stimulus to ensure a durable economic recovery from the worst pandemic since 1918. While the recovery has gained strength, growth has been uneven. Supply chain disruptions and new variants hampered a number of industries throughout the year. Despite these set-backs, strong consumer demand, coupled with lingering effects of monetary and fiscal stimulus, resulted in a resilient foundation.

For equities, the rebound in corporate profits was equally powerful. This led to another year of exceptional returns for domestic stock markets, led by the 28.71% rise in the large capitalization S&P 500. While that index suffered no more than a 5% pullback during the year, different sectors and many individual stocks experienced harsher drawdowns, due to rotation between sectors as economists adjusted their forecasts for the economy.

Overall, equity markets discount changes in real time, which explains the momentum into year-end. For the fourth quarter, the S&P 500 rose 11.03%. Mid and small capitalization indices, represented by the S&P 400 and S&P 600 rose 8.00% and 5.64%, respectively. International stocks underperformed their domestic counterparts, rising only 2.69%, mainly due to a stronger dollar, which was the result of European countries trailing our economic recovery.

Performancei for various indices for the three-month (not annualized), one-year, three-year, and five-year periods appears below:

Bond Indices

| Dates | Bloomberg Credit 1-5 Yr. | Bloomberg US Credit | Bloomberg Muni |

|---|---|---|---|

|

9/30/21- 12/31/21 |

-0.68% | 0.22% | 0.72% |

|

12/31/20- 12/31/21 |

-0.55% | -1.08% | 1.52% |

|

12/31/18- 12/31/21 |

3.69% | 7.17% | 4.73% |

|

12/31/16- 12/31/21 |

2.90% | 5.05% | 4.17% |

Equity Indices

| Dates | Dow Jones Ind. Avg. | NASDAQ Composite | S&P 500 (Large) | S&P 400 (Medium) | S&P 600 (Small) | MSCI EAFE (Int'l) |

|---|---|---|---|---|---|---|

|

9/30/21- 12/31/21 |

7.87% | 8.45% | 11.03% | 8.00% | 5.64% | 2.69% |

|

12/31/20- 12/31/21 |

20.95% | 22.18% | 28.71% | 24.76% | 26.82% | 11.26% |

|

12/31/18- 12/31/21 |

18.49% | 34.26% | 26.07% | 21.41% | 20.11% | 13.54% |

|

12/31/16- 12/31/21 |

15.51% | 24.97% | 18.47% | 13.09% | 12.42% | 9.55% |

Almost two years into the global pandemic, Congress approved approximately $4.5 trillion in aid to support businesses and consumption.ii The U.S. has spent the majority of the funding, but not all of it. There were three separate rounds of stimulus checks to individuals, enhanced child tax credits, and a boost in jobless benefits. Personal savings rates hit new highs in 2020, and while they have since fallen, there is still a buildup of $2.5 trillion in excess savings due to the pandemic.iii This excess savings has created pent-up demand in different areas.

The manufacturing and service sectors have been growing for 19 straight months in the U.S. The rapid return of demand has placed several industries, such as auto manufacturers, in a severe supply shortage since their supply chains were designed for just-in-time inventory delivery. Similarly, there is a distinct advantage to those companies that stockpiled semiconductors during the pandemic and those that did not. Shipping and delivery of goods has also been an issue. According to Cass Information Systems Inc., which handles freight payments for companies, road and rail shipping rates are up 23% this year from 2020.iv Trucking companies and other firms in the supply chain are having difficulty finding workers in the tight labor market and as existing employees get sick and are unable to work.

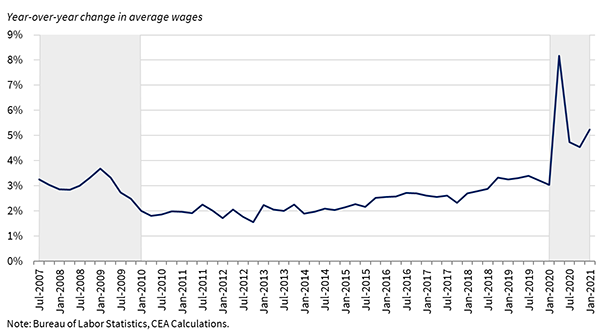

Last quarter, we discussed that it was time for the Federal Reserve (“The Fed”) to begin withdrawing monetary stimulus from the economy; however, the employment situation is a conundrum for the Fed. As people returned to work, we saw the unemployment rate drop from 15% in April of 2020, to 3.9% in December of 2021. However, the labor participation rate is only 61.9%. People are quitting their jobs in record numbers as the “Great Resignation” continues.v There are about 2.4 million workers who have dropped out of the labor force compared to the start of the pandemic. In June, Powell said the country was on its way to a “strong labor market.”vi In December he said, “How long the labor shortages will persist is unclear.”vii There appear to be many jobs, albeit low paying ones, and not many applicants. Therefore, wages have had to adjust higher to meet labor demands, especially on the lower end of the income spectrum. Nowadays, it is not unusual to see signing bonuses in the fast-food industry.

Growth in Average Wages Unadjusted for Composition Effects Spiked During the Pandemic

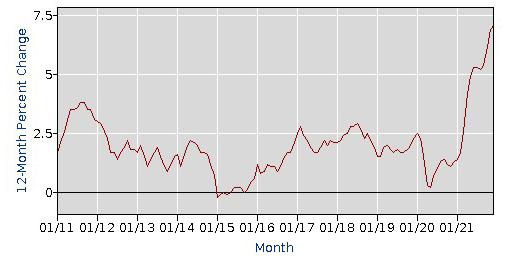

This combination of supply chain problems and rising wages is the perfect cocktail for the higher rates of inflation being experienced today. Over the summer, Powell used the word “transitory” to describe factors that were influencing price levels in the short-term — such as used car and commodity prices. He was surprised by the lingering effects of supply chains that reduced supply in several categories.viii Upward pressure on wages increased the probability that rising prices were becoming less transient, so he finally retired the word in December. Meanwhile, last month’s headline Consumer Price Index (CPI) of 7% was the highest reading in 40 years. The Personal Consumption Expenditures (PCE) index (the Fed’s favored measure of inflation) rose 5.7% year-over-year in November.

Headline CPIix

Source: BLS.gov

In November, President Biden reappointed Jerome Powell as Federal Reserve Chair to serve a second four-year term to maintain stability to the Fed, given other changes on the board. To address concerns over inflation, the Fed announced the beginning of “the taper,” rolling back purchases of treasuries and mortgage backed securities each month. In effect, the Fed is systematically withdrawing economic stimulus given the rebound in the economy.

Similar to the great and powerful Wizard of Oz, Powell has said the Fed can pull a number of levers to stave off high inflation, while keeping their “dual mandate” of maximum employment and price stability. Currently, economists estimate there could be three or four interest rate hikes in 2022. So, the issue at hand is that the potential for a policy mistake is increasing. According to famed economist Mohamed El-Erian, who has worked for both Allianz and PIMCO over a 40-year career, the concern is that “the Fed not going fast enough in the beginning and then having to overdo it later on.”x This would be an environment similar to the fourth quarter of 2018, when the S&P 500 experienced a 20% correction due to concern that the Fed was too aggressive raising short-term rates.

The Fed remains pragmatic and data dependent as we progress into 2022. Risks are elevated as we await how the Fed approaches this cycle of rate increases. West Financial must also be pragmatic. At some point during the year, we may need to reign in equity allocations closer to target if the Fed becomes too aggressive. As is typically the case, any changes to portfolios will be determined on a client-by-client basis.

Our strategy for fixed income investments has not changed. We currently are buying primarily corporate bonds with maturities out to 2029 to capture some additional yield. Where appropriate, we are buying hybrid preferred securities which offer additional yield with a floating rate component. Municipal bonds remain elusive with extremely high prices and very low yields. In the global hunt for yield, even foreign investors are now buying U.S. municipal debt. For equity portfolios, we expect higher volatility this year as investors attempt to outguess central banks. Unless there are cracks in the economy, we view equity declines as buying opportunities. During the volatility, please keep arms and legs inside the vehicle while it’s in motion!

---------------------------------------------------------------

We are pleased to announce in November, Matt Cohen, Kim Cox, Brian Horan, Abby Just, Cheryl Langston, and Brian Mackin were recognized as Five Star Wealth Managers by Five Star Professional. We also wish to congratulate one of our founders, Glen Buco, on his 40th year with West Financial! Congratulations to all!

As West Financial Services enters its 40th year, now with 38 employees, and over $2 billion in assets under management, we would like to thank you for your continued confidence in our investment management and financial planning services. We will be celebrating this milestone all year long, so feel free to share thoughts on your own journey over the years with the WFS team.

You will be receiving Form 1099-DIV (dividends) and 1099-INT (interest) information directly from your accounts’ custodian(s), as well as the Form 1099-B, which will provide a record of realized gains and/or losses in taxable account(s) and any management fees paid directly from your brokerage account(s).

We have provided performance reports for the quarter, one-year, three-year, and five-year periods, where applicable through December 31, 2021. In addition to your statements, your packet will include any restrictions that you have placed on your account. Please review these and contact us should there be any changes. Also, now would be a good time to review your asset allocation and risk tolerance. If you have had any changes to your income, marital status, state of residence, tax bracket, etc., please be sure to let us know.

Should you have any questions regarding your portfolio, or any financial planning related questions, please call us at any time. Please do not hesitate to refer friends, family, or co-workers who you feel may benefit from our services. We wish all of you and your families a happy, safe, and prosperous 2022.

|

President

|

Chief Investment Officer

|

Director of Fixed Income

|

|---|---|---|

|

|

|

| Glen J. Buco, CFP® | Glenn Robinson, CFA | Norma Graves, CFP® |

i Each of the S&P 500 Index, the S&P 400 Index, the S&P 600 Index, the MSCI EAFE Index, the Barclays Credit 1-5 Year Index, the Barclays Cap U.S. Credit Index, the Barclays Capital Municipal Bond Index, the Dow Jones Industrial Average, and the NASDAQ Composite (each, an “Index”) is an unmanaged index of securities that is used as a general measure of market performance. The performance of an Index is not reflective of the performance of any specific investment. Each Index comparison is provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of your account and each Index may not be comparable. There may be significant differences between the characteristics of your account and each Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Index reflects no adjustment for client additions or withdrawals, and no deduction for fees or expenses. Accordingly, comparisons against the Index may be of limited use. Investments cannot be made directly into an Index.

ii https://www.cnbc.com/2021/12/09/covid-relief-bills-us-has-spent-most-of-coronavirus-aid-money.html

iii https://www.nytimes.com/2021/12/07/business/pandemic-savings.html

vi https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20210616.pdf

x https://thesoundingline.com/el-erian-yield-curve-signaling-policy-mistake/

xi The Five Star Wealth Manager Award, managed by fivestarprofessional.com, conducts market-specific research throughout the U.S. and Canada to select reputable, specialized, and honest service professionals. Award candidates who satisfied 10 objective criteria were named 2021 Five Star Wealth Managers. Required Eligibility Criteria : 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively employed as a credentialed professional in the financial services industry for a minimum of five years; 3. Favorable regulatory and complaint history review; 4. Fulfilled their firm review based on internal firm standards; and 5. Accepting new clients. Additional Evaluation Criteria :1. One-year client retention rate; 2. Five-year client retention rate; 3. Non-institutional discretionary and/or non-discretionary client assets administered; 4. Number of client households served; and 5. Education and professional designations.

West Financial Services, Inc. (“WFS”) offers investment advisory services and is registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the firm has attained a particular level of skill or ability. You should carefully read and review all information provided by WFS, including Form ADV Part 1A, Part 2A brochure and all supplements, and Form CRS. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security. You are solely responsible for reviewing the content and for any actions you take or choose not to take based on your review of such content.

This information is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Certain information contained herein was derived from third party sources as indicated. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any information presented. WFS has not and will not independently verify this information. Where such sources include opinions and projections, such opinions and projections should be ascribed only to the applicable third party source and not to WFS.

Certain statements herein reflect projections or opinions of future financial or economic performance. Such statements are “forward-looking statements” based on various assumptions, which may not prove to be correct. No representation or warranty can be given that the projections, opinions, or assumptions will prove to be accurate.