Special Release - Keep Calm and Carry On

After an extremely strong third quarter for equity returns, sentiment quickly turned negative in October as investors grew wary over 2018 being the “peak” year for growth. “Peak growth” refers to the maximum rate of expansion for this cycle, not an end to growth for the economy or corporate profits. There are several factors contributing to this adjustment in sentiment:

- The Federal Reserve continues to tighten monetary policy, both by raising short-term interest rates and reducing the portfolio of bonds amassed during quantitative easing programs since the financial crisis.

- The global synchronized expansion hit a pothole with economies in Europe and emerging markets slowing down. The tariff war with China is intensifying this weakness; however, the U.S. continues to power ahead.

- This decoupling rate of growth is driving the U.S. dollar higher, which hurts corporate profit growth for companies with international sales.

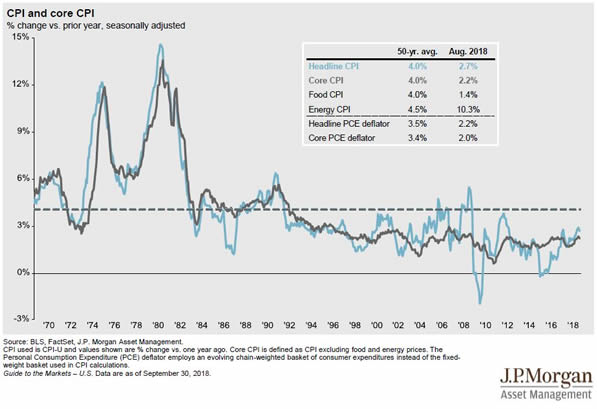

- Domestically, wages are rising and tariffs are boosting the input costs for industries reliant on steel and aluminum. The Federal Reserve is concerned about the impact of these factors on inflation expectations.

- Housing is becoming less of a tailwind to growth due to falling affordability and slower sales.

Though 2018 may experience the fastest rate of growth, we are still positive on the economic expansion heading into 2019. Importantly, the mid-term election is behind us, and the outcome is a “known known.” Meanwhile, employment remains strong and wages are rising. These factors are increasing consumer confidence, with the Conference Board’s latest measure at its highest level in 18 years. This should support consumer spending, which makes up 70% of the U.S. economy. Leading economic indicators are also hitting new highs for this expansion – led by manufacturing, strong durable goods orders, and tight credit spreads.

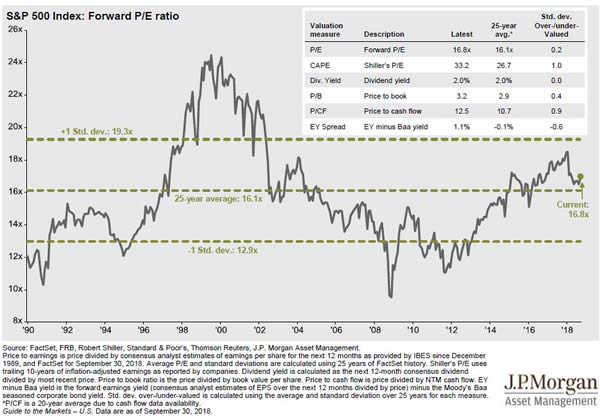

With a strong backdrop, the current pullback in stock prices has lowered the overall valuation of the S&P 500. The index now trades on a multiple of forward earnings expectations of just over 15x, down from 18x at the start of the year. Corporations are flush with cash due to the change in tax law, resulting in share buyback announcements surpassing one trillion dollars this year.

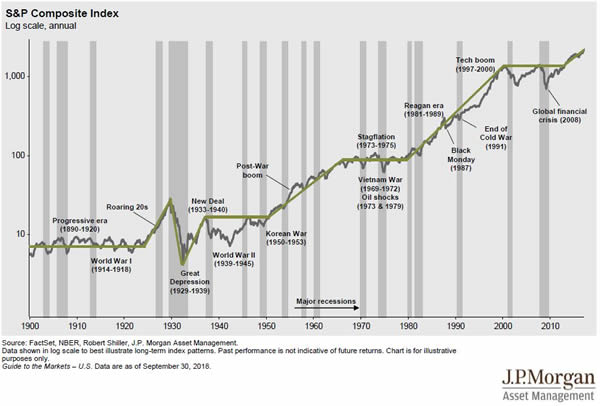

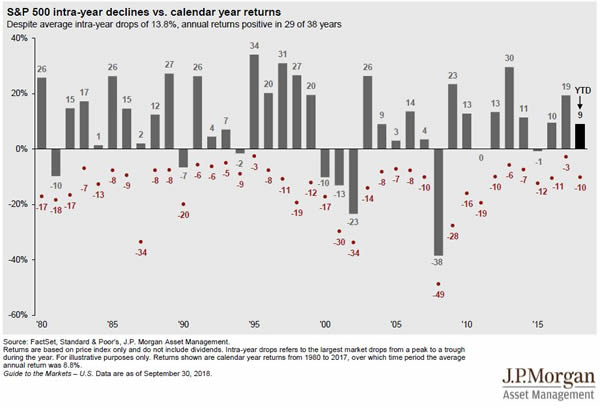

To repeat a phrase we have used many times in the past, in the short-term, equity markets can deviate from the underlying fundamentals, but it is the fundamentals that win out in the end.

Stock Market Since 1900

S&P 500 Valuation Measures

Annual Returns and Intra-Year Declines

Inflation

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular adviser or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisers. West Financial can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.