Financial Planning Focus - Charitable Giving Strategies Under the Tax Cuts and Jobs Act

Approximately 30 percent of taxpayers itemize deductions, according to the Tax Policy Center of the Urban Institute and Brookings Institution, and roughly 82 percent of itemizers reported charitable contributions. Prior to the passage of the Tax Cuts and Jobs Act (TCJA), the standard deduction for a single taxpayer was $6,350 and $12,700 for a married couple (MFJ). The TCJA raised the standard deduction to $12,000 (single) and $24,000 (MFJ). The TCJA also placed a limit on the deductible amount of state and local taxes (SALT), and eliminated miscellaneous deductions entirely. Charitable deductions were not limited in the TCJA, making it one of the few remaining areas for tax savings.

Many taxpayers will no longer itemize deductions due to these limitations. For high income earners, strategies for exceeding the standard deduction are limited in that most deductions represent costs, such as state and local taxes and mortgage interest, which are required to be paid when the amounts are due. Of the deductions mentioned above, only charitable contributions are voluntary. Note that taxpayers can deduct charitable contributions up to 60% of adjusted gross income (up from 50%). The challenge then becomes how to time charitable contributions and maximize the tax benefit of the contribution. One strategy is to lump multiple years of charitable contributions in one year to help exceed the standard deduction.

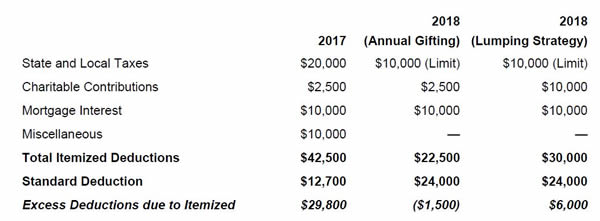

The following example shows 2017 itemized deductions for a married couple in the 24 percent tax bracket, and projections for 2018 deductions under the current charitable gifting amounts and assuming a lumping strategy:

For taxpayers who are charitably inclined, a lumping strategy creates an opportunity to save money on taxes. In the above example, while the couple is able to take a significant itemized deduction in 2017, the TCJA limits result in having to use the standard deduction in 2018. With a charitable lumping strategy of combining four years’ contributions in one year, the itemized deduction exceeds the standard deduction for the year.

While you can make the higher charitable contribution in cash, another idea would be to create a donor advised fund (DAF) for periodic larger contributions. A donor advised fund is an investment vehicle for charitable contributions that will grow over time. Contributions to the donor advised fund are deductible as if they were made to a qualifying organization in the year that they are made. From the DAF you can make periodic bequests to charitable organizations in future years, however, these distributions are not tax deductible. Taxpayers should strongly consider establishing a DAF if they have a high-earning year followed by years of low-earnings, large capital gains, or will be below the standard deduction.

If you have any questions regarding how the Tax Cuts and Jobs Act will affect your taxes, please consult your West Financial Services advisor. Having a proactive charitable gifting strategy can save you thousands of dollars over time.

Important Disclosures

-

Registration does not imply a certain level of skill or training.

-

Any conclusions presented or hypotheticals presented are based upon facts derived from publicly available information, and are also based on certain assumptions, including that there are no additional changes to current law, and that demographic information regarding retirement accounts also remains unchanged. Further, hypothetical scenarios presented are solely presented for the purposes of demonstrating available retirement options, and do not include any information, analysis, or conclusions regarding other areas of an individual’s financial future.

-

Certain information presented includes facts and analysis the accuracy of which is dependent upon current regulations regarding taxes remaining unchanged. Changes in tax law or other rules could materially, and adversely, affect any financial or retirement plan. Therefore, no person reading this material should accept this information as investment advice.

-

Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.