Investment Management - Third Quarter 2021

We provide a copy of our investment management letter, without enclosures, to keep you up-to-date on the investment markets and West Financial Services.

Ground Control to Chairman Powell…

Over the past 18 months, we suggested that the Federal Reserve’s (“the Fed”) policy response to the global pandemic has been a success, acknowledging in the last quarterly letter that it may be about time to end emergency funding policies. The members of the Fed have completed their pre-flight check, have their helmets on, and are ready for tapering. The latest Federal Open Market Committee statement said, in part, “If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.”i Unless there is a significant surprise over the next 30 days, the Fed is likely to announce a decision on tapering asset purchases of U.S. Treasuries and mortgage-backed securities at their November meeting. Commencing countdown, engines on!

This has been expected, as the U.S. economy has fully recovered from the pandemic, with the dollar value of U.S. GDP surpassing its pre-pandemic peak. A combination of strong economic growth and monetary stimulus continues to benefit equity markets. The S&P 500 achieved a number of record highs during the third quarter, peaking at 4,537 on September 2nd, up 22% year-to-date.ii Since then, concerns over valuations, inflation, and the debt ceiling debate caused the index’s first 5% pullback of the year.

For the third quarter overall, the total return for the S&P 500 was 0.58%. The S&P 400 & S&P 600 returned -1.76% and -2.84%, respectively. International stocks, tracked by the MSCI EAFE Index, fell a fraction of a percent, or 0.45%.

Performanceiii for various indices for the year-to-date (not annualized), one-year, three-year, and five-year periods appears below:

Bond Indices

| Dates | Barclays Credit 1-5 Yr. | Barclays Cap US Credit Index | Barclays Muni |

|---|---|---|---|

|

12/31/20- 9/30/21 |

0.13% | -1.30% | 0.79% |

|

9/30/20- 9/30/21 |

1.08% | 1.45% | 2.63% |

|

9/30/18- 9/30/21 |

4.25% | 7.10% | 5.06% |

|

9/30/16- 9/30/21 |

2.85% | 4.37% | 3.26% |

Equity Indices

| Dates | Dow Jones Ind. Avg. | NASDAQ Composite | S&P 500 (Large) | S&P 400 (Medium) | S&P 600 (Small) | MSCI EAFE (Int'l) |

|---|---|---|---|---|---|---|

|

12/31/20- 9/30/21 |

12.12% | 12.66% | 15.92% | 15.52% | 20.05% | 8.35% |

|

9/30/20- 9/30/21 |

24.15% | 30.26% | 30.00% | 43.68% | 57.64% | 25.73% |

|

9/30/18- 9/30/21 |

11.00% | 22.67% | 15.99% | 11.08% | 9.44% | 7.62% |

|

9/30/16- 9/30/21 |

15.68% | 23.37% | 16.90% | 12.97% | 13.57% | 8.81% |

The strong rally in equities has been supported by a rebound in corporate profits. Entering calendar year 2021, forecasts for earnings-per-share (EPS) growth were around 20%. That figure has increased substantially, to approximately 42.8% EPS growth, after the first two quarters of earnings reports.iv Despite rising wages, many of the largest corporations have been able to maintain or expand operating margins. Better than expected EPS growth has another positive effect in that valuations for the index have contracted. The forward price-to-earnings multiple for the S&P 500 fell from 22.4x forward earnings expectations to 20.3x. That compares to the 25-year average of 16.8x.v Valuations remain high due to the Fed’s quantitative easing and low, long-term interest rates, but are not in orbit.

In our last letter, we discussed a few crosscurrents that central banks will have to navigate going forward. Growth is decelerating in the world’s two largest economies. China is the furthest along in this new economic expansion, though the Chinese communist party is focused on ensuring their long-term vision of China, and less concerned about the short-term impacts to their economy and certain industries. In the U.S., domestic growth has peaked while inflation remains elevated. There are a multitude of factors influencing recent inflation data.

From the Merriam-Webster dictionary, the definition of transitory: 1: of brief duration: temporary 2: tending to pass away: not persistent. Fed Chairman Powell would have us all believe this by repeating the term over and over again. However, inflation numbers are running the hottest we have witnessed in 30 years. The most recent headline Personal Consumption Expenditure Price Index (the number most closely watched by the Fed) came in at 4.3%, while the core number, excluding food and energy held at 3.6%.vi

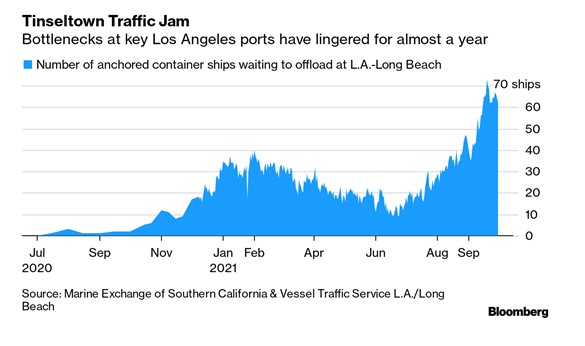

Rampant supply chain problems from ships, to rail, to trucks are causing shortages from toys, to industrial parts, to semiconductors, to name a few areas impacted. Dozens of ships float offshore waiting to unload goods while rail lines are seeing up to 25-mile long back-ups at some facilities. Meanwhile, costs associated with the broken supply chain are being passed down to consumers. From the Washington Post, “In September, the median cost of shipping a standard rectangular metal container from China to the West Coast of the United States hit a record $20,586, almost twice what it cost in July, which was twice what it cost in January, according to the Freightos index.”vii Fed Chairman Powell recently remarked, “Inflation is elevated and will likely remain so in coming months before moderating.”viii Expectations are that these supply chain problems will last through 2022 and into 2023.

As central banks consider action, global markets are acting preemptively and sovereign yields are beginning to rise. The 10-year treasury recently reached a 1.58% yield, an amount not seen since June. The Fed is keeping a watchful eye on employment, as the unemployment rate has fallen to 4.8% from almost 15% at the start of the pandemic. What is worrisome for the Fed is the labor participation rate. The share of people working has been at 61.7% or below since April, far below 63.4% seen in January 2020. What we are seeing is that people are still sitting on the sidelines or dropping out of the workforce.

Making predictions multiple years out is a difficult endeavor. We believe the level of inflation will eventually moderate, given aging global demographics in developed economies, along with the deflationary impacts of globalization and advancing technology. During periods of moderate inflation, certain areas of the equity market can perform well. Companies in the materials and energy sectors have a built-in hedge to rising commodity prices. Firms with pricing power can also exhibit sales growth while maintaining margins, since they are able to pass along higher input costs. Lastly, companies with plentiful free-cash-flow can boost dividends faster than the rate of inflation. Our diversified barbell strategy includes high-quality, dividend payers with our favorite secular growth themes.

For fixed income allocations, we continue to favor corporate bonds over municipal bonds. Medium-term investment grade BBB rated bonds are yielding more than twice as much as Virginia municipal bonds. We continually evaluate the yield curve to determine how far out our maturities should be. Currently, we are buying out to 2029, where the yield curve begins to flatten. With inflation in the headlines, we are often asked whether we should be buying Treasury Inflation-Protected Securities (TIPS). Currently 10-year TIPS have a negative yield of almost -1.0%. We don’t favor purchasing negative yields. The breakeven point between a conventional 10-year treasury and a 10-year TIPS is 2.45%, indicating if one believes inflation will run stronger than 2.45%, you would be better off buying the TIPS. That is the case today, but for how long?

Space has always been the final frontier to adventurers and sci-fi enthusiasts. Thank you to David Bowie for the inspiration for this letter, and congratulations to actor William Shatner for boldly going where only a small number of humans have gone before. Here at West, we remain well grounded.

---------------------------------------------------------------

In September we hosted our second “Under the Hood” webinar, “Making the Case for Mutual Funds and ETFs.” If you missed it, a recording is available on our website. You can also find a recording of our first “Under the Hood — Investment Management Philosophy” in the video archives on our website.

Also in September, Kristan Anderson, Glen Buco, and Kim Cox were named to the Northern Virginia Magazine’s Top Financial Professionals listing.ix This is the 11th consecutive year we have been included in this list and we are honored to be recognized by our peers. In July, West Financial Services was included in Financial Advisor magazine’s “2021 RIA Ranking by Total Assets.”x

As we enter the final quarter of the year, please contact us should you have any questions or concerns regarding your year-end tax planning and/or gifting needs. We are compiling year-end capital gain estimates from the mutual funds we invest in on your behalf, and will be happy to provide this information to you and/or your accountant upon request. You should be receiving statements directly from your account custodian at least quarterly. If you are not receiving your statements, please contact us.

|

President

|

Chief Investment Officer

|

Director of Fixed Income

|

|---|---|---|

|

|

|

| Glen J. Buco, CFP® | Glenn Robinson, CFA | Norma Graves, CFP® |

ihttps://www.federalreserve.gov/newsevents/pressreleases/monetary20210922a.htm.

iiBloomberg Daily Market Prices for Close of Business 10/15/21.

iiiEach of the S&P 500 Index, the S&P 400 Index, the S&P 600 Index, the MSCI EAFE Index, the Barclays Credit 1-5 Year Index, the Barclays Cap U.S. Credit Index, the Barclays Capital Municipal Bond Index, the Dow Jones Industrial Average, and the NASDAQ Composite (each, an “Index”) is an unmanaged index of securities that is used as a general measure of market performance. The performance of an Index is not reflective of the performance of any specific investment. Each Index comparison is provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of your account and each Index may not be comparable. There may be significant differences between the characteristics of your account and each Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Index reflects no adjustment for client additions or withdrawals, and no deduction for fees or expenses. Accordingly, comparisons against the Index may be of limited use. Investments cannot be made directly into an Index.

ivButters, John. “Earnings Insight.” FACTSET, 10/8/21.

vJ.P. Morgan Guide to the Markets® 4Q2021 as of 9/30/21.

vihttps://www.bea.gov/data/personal-consumption-expenditures-price-index.

viiihttps://www.federalreserve.gov/mediacenter/files/FOMCpresconf20210728.pdf.

ixTo compile the Top Financial Professionals list, Northern Virginia Magazine enlisted input from the Certified Financial Planner Board of Standards, Inc. (the “CFP Board”) which grants and upholds the CFP® designation as a recognized standard of excellence in personal financial planning. Using data provided by the CFP Board, Northern Virginia Magazine asked CFP® certificants and other finance professionals in Northern Virginia to nominate peers. The “Top Financial Professional” listing is given to those financial advisors that receive the most nominations. Financial professionals do not pay a fee to be included.

xFinancial Advisor Magazine ranks advisers from across the nation by total assets under management, growth in assets, assets per client, growth in assets per client and the percentage change in number of clients based on a survey conducted by Financial Advisor Magazine of investment advisers registered with the SEC. Only RIAs participating in the survey are included in the rankings. Assets under management totals are taken from each firm’s Form ADV. Investor experience and returns were not considered as part of this ranking. RIAs do not pay a fee to be included in the Financial Advisor ranking.

West Financial Services, Inc. (“WFS”) offers investment advisory services and is registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the firm has attained a particular level of skill or ability. You should carefully read and review all information provided by WFS, including Form ADV Part 1A, Part 2A brochure and all supplements, and Form CRS. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security. You are solely responsible for reviewing the content and for any actions you take or choose not to take based on your review of such content.

This information is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Certain information contained herein was derived from third party sources as indicated. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any information presented. WFS has not and will not independently verify this information. Where such sources include opinions and projections, such opinions and projections should be ascribed only to the applicable third party source and not to WFS.

Certain statements herein reflect projections or opinions of future financial or economic performance. Such statements are “forward-looking statements” based on various assumptions, which may not prove to be correct. No representation or warranty can be given that the projections, opinions, or assumptions will prove to be accurate.