Recessions and the Stock Market

There is much talk today that we may be headed for another recession. Our latest management letter, “Fishing for Confidence at Jackson Hole” includes a discussion of how the Federal Reserve, in an attempt to tamp down inflation, may create some unwanted economic side effects. Namely, higher interest rates, slower growth, and softer labor market conditions. The media is constantly bombarding us with this news.

What is a recession?

An economy is in a recession when it contracts for six months or longer. The definition most widely accepted is two quarters of negative Gross Domestic Product (GDP) growth. Since 1945 there have been 13 recessions in the U.S., with the last once occurring in 2020 during the initial COVID outbreaki.

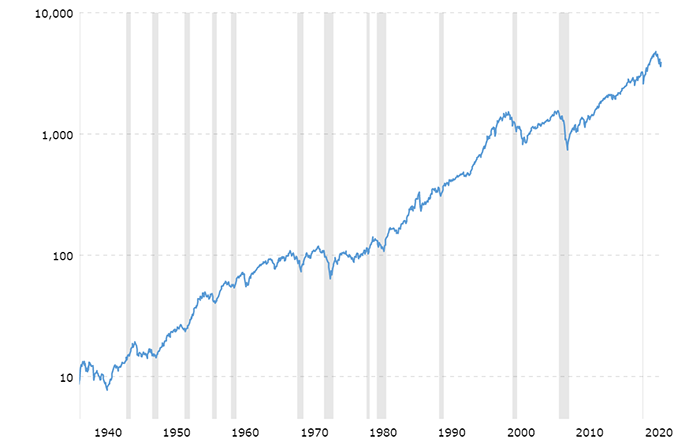

Recessions vary considerably in depth, breadth, and length. Thankfully, not all recessions are as bad as The Great Recession / Financial Crisis. While it is certainly painful for folks who lose jobs and/or face financial uncertainty, the U.S. economy has always bounced back - and then some. Jobs come back and the economy rolls along. The chart below illustrates the unprecedented growth of the U.S. economy post World War II.

What happens to the stock market before, during and after a recession?

The S&P 500 actually rose an average of 1% during all recession periods since 1945. In over half of the 13 years with recessions since 1945, the S&P 500 has posted positive returnsii.

Why would the stock market go up during a recession? Well, picture this: You are an investor who analyzes the economy and the markets all day every day (e.g., us here at WFS). You spend your days forecasting future possibilities and probabilities so that you can make the best decisions as to where to invest. The key word here is future. Now multiply this by all of the other investors in the market. If the consensus opinion is that we are headed for a recession, then that consensus opinion is normally already priced into the stock market. Investors have already traded in their portfolios in anticipation of a recession.

The market typically begins to sell off before a recession. The chart below shows the stock market with the shaded areas representing recessions.

S&P 500 (log scale), Recessions in Shaded Areas

Source: S&P Global

The other thing about recessions is that we won’t officially know we are in one until after the fact. It takes a while to compile all of the data needed to make that call. We could be out of a recession before we even knew we were in one!

Most important: The stock market has fully recovered and continued to go up from there following every recession. Every single one. I believe that trend will continue going forward. The majority of publicly-traded companies are in good financial shape. These firms can easily withstand any short-term blip in the economy. The world continues to develop. New middle class consumers create increased demand for products and services. Advances in technology and health care will continue to improve living conditions for people worldwide. In my opinion, now is a great time to start putting money to work for the long term.

Can I “recession proof” my finances?

If you haven’t already done so, now is a great time to update your financial plan. If you don’t yet have a financial plan, it’s a great time to begin talking with a professional about putting one together. Financial plans can provide peace of mind and alert you to any shortfalls or other important financial issues that need to be addressed - especially in times of uncertainty, such as a recession. If you have a solid financial plan and follow it, you just may be able to “recession proof” your finances, or at least have confidence in a plan that prepares you for life’s twists and turns.

So hang in there, and give us a call if you want to talk about it.

Read the Financial Planning Focus November 2022:

"The Year End Gift You May Not Be Expecting" by Brian J. Horan, CPWA® »

"Gauging Forward Return Expectations" by Ryan Streilein, CFA »

iNational Bureau of Economic Research

iiCFRA Research, Federal Reserve

Important Disclosures

- West Financial Services, Inc. (“WFS”) offers investment advisory services and is registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the firm has attained a particular level of skill or ability. You should carefully read and review all information provided by WFS, including Form ADV Part 1A, Part 2A brochure and all supplements, and Form CRS.

- Certain information contained herein was derived from third party sources, as indicated, and has not been independently verified. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any information presented. Where such sources include opinions and projections, such opinions and projections should be ascribed only to the applicable third party source and not to WFS.

- This information is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. You should not treat these materials as advice in relation to legal, taxation, or investment matters. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisers.